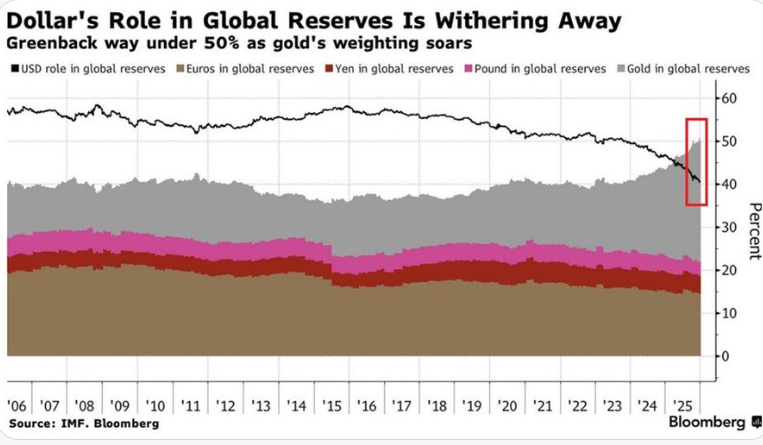

n a striking shift reshaping the global financial landscape, gold has emerged as a formidable contender in central bank reserves, overtaking traditional currency holdings and challenging the U.S. dollar’s supremacy. Recent data from the International Monetary Fund (IMF) reveals that the greenback’s share in total global official reserves has dipped below 50%, while gold’s weighting has soared to over 20%, marking a pivotal moment in the ongoing de-dollarization trend.

A visual representation of this transformation, based on IMF figures through the first quarter of 2025, illustrates the dollar’s steady decline from around 60% in the mid-2000s to approximately 42.5% today. Meanwhile, gold’s portion has more than doubled since 2015, climbing from under 10% to 20.7% as central banks stockpile the precious metal amid geopolitical uncertainties and economic volatility. This surge reflects a broader diversification strategy, with emerging economies leading the charge in gold acquisitions.

The IMF’s latest annual report appendices highlight the numbers: Total global official reserves stood at 12,820 billion special drawing rights (SDRs) – equivalent to about $16.7 trillion – as of March 2025. Foreign exchange reserves, the largest component, totaled 9,415 billion SDRs, but gold’s market value jumped 15.4% in the quarter to 2,650 billion SDRs, representing 20.7% of the total – up from 18.3% at the end of 2024. In physical terms, central banks held 1,166 million troy ounces of gold, with emerging markets increasing their stockpiles by 2.6% in the prior year.

Within foreign exchange reserves, the dollar still commands the lion’s share at 57.8%, but when factored into overall reserves (including gold, SDRs, and IMF positions), its effective portion shrinks significantly. The euro follows at 19.8% of FX reserves (about 15% overall), the Japanese yen at 5.8% (4.4% overall), and the British pound at 4.7% (3.6% overall). This recalibration has positioned gold as the second-largest reserve asset globally, surpassing the euro in some analyses.

Experts attribute this pivot to several factors. U.S. policies, including sweeping tariffs under President Donald Trump, escalating national debt, and the weaponization of the dollar through sanctions – such as the freezing of $300 billion in Russian assets post-2022 Ukraine invasion – have eroded trust among Global South nations. China’s shift toward a more flexible yuan exchange rate and reduced current-account surpluses has lessened its reliance on dollar hoarding, while Gulf states are channeling oil revenues into domestic projects rather than U.S. Treasuries. Central banks, wary of currency volatility and geopolitical risks, view gold as a neutral, inflation-hedging safe haven.

“The dollar’s exorbitant privilege is on borrowed time,” noted a recent opinion piece, echoing concerns that diminishing foreign demand for U.S. assets could elevate borrowing costs and constrain Washington’s global influence. Projections suggest that if trends persist, the dollar’s FX reserve share could fall further, potentially to 24% in China’s holdings by 2050 under moderate scenarios.

This evolution carries profound implications. For the U.S., a reduced role could mean higher interest rates, pricier imports, and diminished leverage in international affairs. Globally, it fosters a multipolar financial system, with the yuan’s trade invoicing rising to 25% and local currencies gaining traction in emerging markets. However, barriers like the eurozone’s fragmentation and China’s capital controls slow a full transition away from the dollar.

As gold’s allure grows – with prices hitting record highs amid 2025’s economic turbulence – central banks’ buying momentum shows no signs of abating. The World Gold Council reports 43 tonnes added by one major buyer alone in recent months, underscoring gold’s ascent as a cornerstone of reserve strategies. In an era of uncertainty, the yellow metal is not just shining brighter; it’s redefining the very foundation of global wealth.