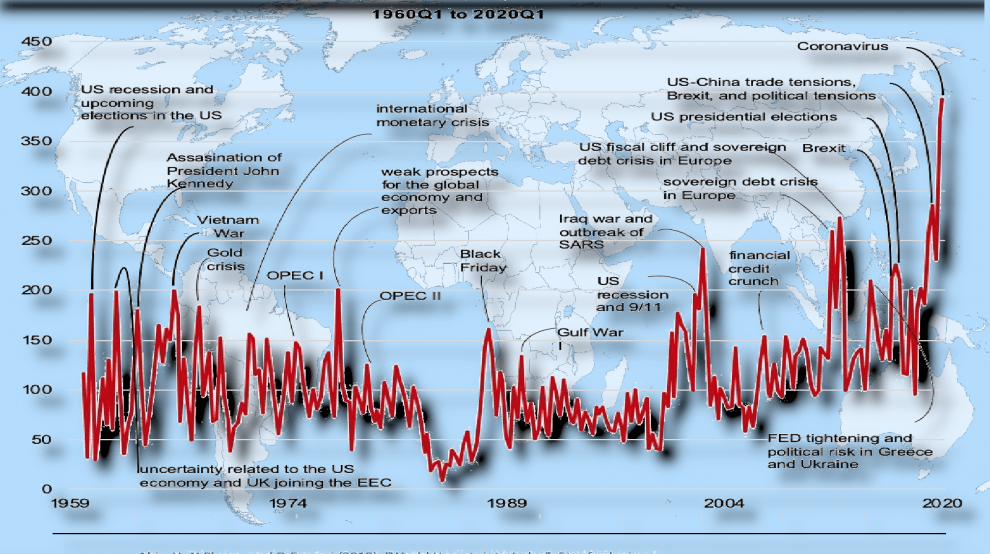

Well, it is not a secret that no thanks to the least popular living thing ever, pretty much the entire global economy has suddenly stopped (except for pharmaceuticals and personal hygiene industries perhaps), the stock markets plunged, and VIX index (which indicates how volatile SP 500 index is expected to be by the market players) went literally off the charts.

So what now? When will the global economy bounce back?

This basically depends on how accurate the spread of the coronavirus is predicted. Although there are concerns that some governments are reluctant to provide true numbers of the infected and deceased, the common opinion is that we have enough data and means to simulate how the virus is likely to spread. Given the circumstances and the nature of this unprecedented phenomenon, it may be said that the markets are well-aware of the worst possible scenario and already priced it to a great extent – by literally selling everything away. So more or less, within the short term, there seems to be (although fragile) equilibrium.

Within the long term, the actual impact of the virus on businesses and economies will be able to be observed better. However, probably the only silver lining in relation to this mess, is the unprecedented liquidity provided (and is promised to be provided) by the governments. Similar to the corona pandemic, the amount of money to be pumped into global businesses and markets is unprecedented as well: We are talking about trillions and trillions of dollars for the first time, well, ever! Given that the pandemic will be more manageable within the foreseeable future, that is a lot of money coming our way.

So what about Turkey in particular? Turkey, who did a rather successful job in managing the corona virus thanks to its well-developed and respected health system, is likely to benefit from the said liquidity similar to other EM countries. That is, convenient access to cheap funds will once again allow Turkey to aggressively grow like just a few years back, and definitely will help the domestic dollarization issue. Turkish Stock Market is already so ridiculously priced that it is possible to acquire very successful and internationally reputable companies merely with their 4-5 years’ profits. That is very, very cheap guys! Probably a once-in-a-lifetime opportunity for smart investors.

So once the doom and gloom days are over and the sun is up back again, there are plenty of reasons to be optimistic about the future global economy. So what we just need to do for the time being, is to stay at home, stay safe and pray for those who are suffering from the coronavirus at the moment.

Add Comment